About Us

Since 2001, Akhuwat has been working for Poverty Alleviation

Akhuwat is a not-for-profit organization which was founded in 2001 on the Islamic principle of Mawakhat (مواخات) or solidarity. The concept of Mawakhat predates to 622 CE when Prophet Muhammad (Peace Be Upon Him) urged the residents of Medina (Ansars) to share half of their belongings with the Muhajirs (migrants) who were forced to flee persecution and migrated from Mecca to Medina.

Drawing inspiration from the generosity displayed by the Ansars, Akhuwat believes that if the same approach, where one affluent family embraces a less fortunate one is adopted today, inequality will be eradicated from the world.

Check Loan Status

- We have recently become aware of individuals impersonating Akhuwat Foundation representatives and soliciting money from the public. Before engaging with anyone claiming to represent Akhuwat Foundation, verify their credentials with us. Remember, only Akhuwat Foundation grants loans, and any suspicious activities should be reported immediately. Stay vigilant and contact us directly for any concerns or verification. Thank you for your cooperation.

Projects and Programs

Usefull Links

- Board Of Directors

- Branch Network

- Akhuwat Progress Report

- Impact Assessment Reports

- Loan Process

- Loan Products Offered

- Testimonials

Akhuwat

Islamic Microfinance

Akhuwat

Education Services

Usefull Links

- Akhuwat College for Women Chakwal

- NJV School

- Akhuwat FIRST

- Akhuwat College Kasur

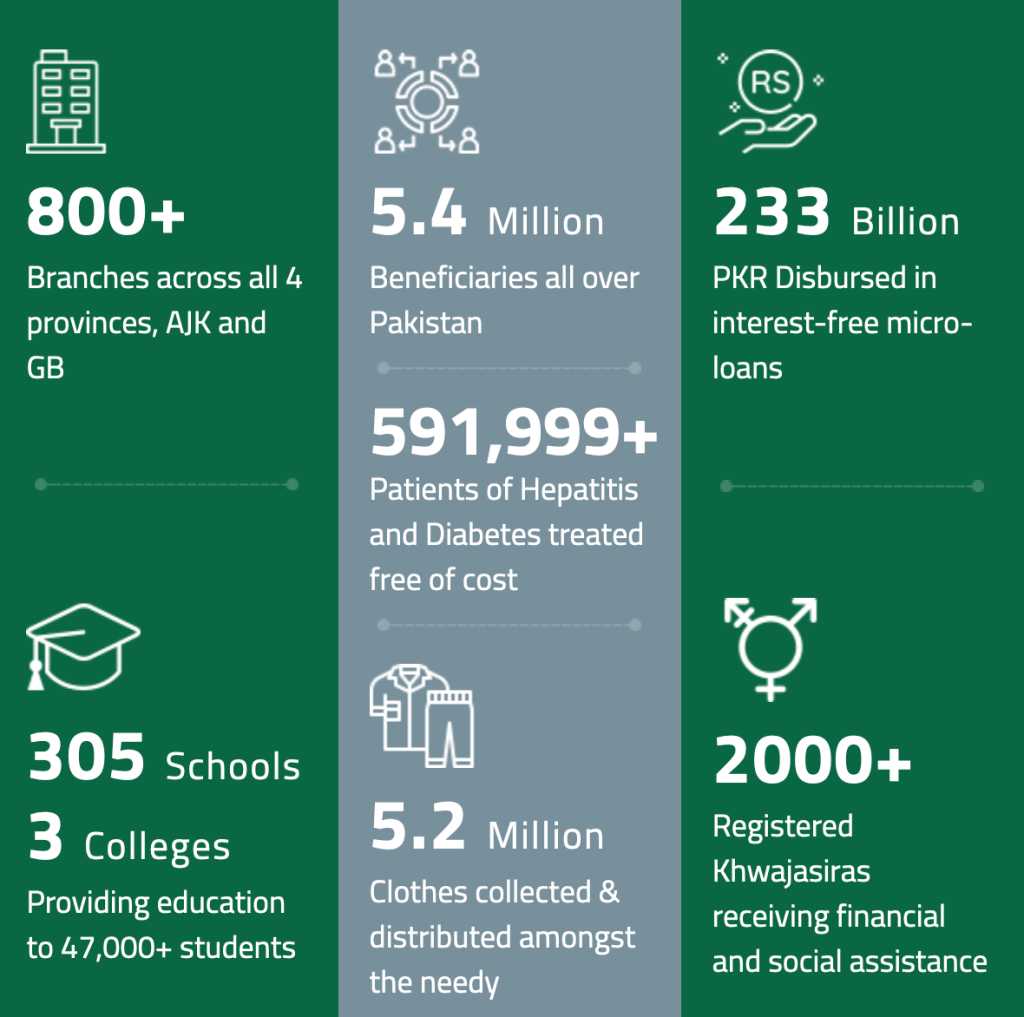

Therefore, Akhuwat’s vision of creating a poverty-free society would remain incomplete unless the root cause; illiteracy, was addressed. Therefore, Akhuwat’s vision of creating a poverty-free society would remain incomplete unless the root cause; illiteracy, was addressed.

47,000+

Students

Usefull Links

- Contact us

- Progress Report

Akhuwat

Clothes Bank

3.0

Million Beneficiaries

3.23

Million Clothes Collected

Akhuwat Clothes Bank collects, sorts and cleans donated clothing & gifts and presents them to low-income families. These gifts are disbursed throughout the year while special campaigns are carried out during peak winter season and natural disasters.

Akhuwat Khwajasira

Support Program

Usefull Links

- Linkages established

- How can you help?

- Contact

The social and economic exclusion of the Khwajasira or transgender (Third Gender). community in Pakistan has left them dependent on alms, vulnerable to exploitation and increasingly susceptible to abuse. Realizing this and the consequent need for action in this arena, Akhuwat, in collaboration with Fountain House launched the Akhuwat Khwajasira Support Program in 2011. The program works with the vision of creating a system of support for members of the Khwajasira community.

2000+

Registered Khwajasira

Akhuwat

Health Services

591,999

Beneficiaries

Akhuwat Health Services (AHS) serves the poor through affordable and effective health care services. It provides subsidized medicines, lab tests, free examination and consultation to those families that are unable to afford basic health care. In 2009, AHS set up a health center in Township, Lahore…

Frequently Asked Questions

You can check the status of your Akhuwat loan application by visiting the official website. Once your loan is approved, the funds will be disbursed to your bank account within a few hours.

Yes, Akhuwat Foundation is a genuine loan provider. It offers personal loans ranging from Rs. 1 lakh to Rs. 5 crore with loan terms from 1 to 10 years. Akhuwat Foundation is affiliated with HBL Bank and has a strong reputation, with a 5-star rating from Ehsas Program Guides. The organization has been in operation for 15 years and holds an “A” rating from the Better Business Bureau.

Akhuwat Foundation offers interest-free loans starting from Rs. 50,000 up to Rs. 1 crore, available for application online.

Once your loan is approved, the funds are typically transferred to your bank account within a few hours.

Akhuwat Foundation provides various loan options, including personal, home, car, education, and business loans, catering to a wide range of financial needs.

Akhuwat Fondation loan 2024

Founded in 2001 by Dr. Amjad Saqib, Akhuwat has adopted an innovative and compassionate approach to microfinance, one that stands out due to its interest-free loan policy.

Our Partners